India loads up on Russian dirty fuel with crude supply cuts – Times of India

[ad_1]

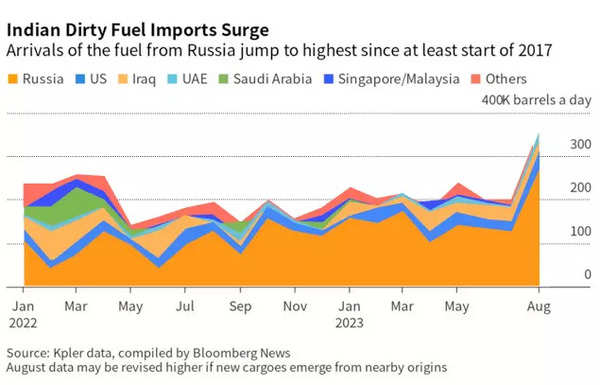

August imports of sludgy products from Russia should double from last month to about 269,000 barrels a day, initial data compiled by Bloomberg from analytics firm Kpler show. That would be the most since at least early 2017.

The flows mostly include high-sulfur fuel oil and vacuum gasoil, which can be used in secondary refining units to improve yields of higher-value products like diesel and gasoline. Fuel oil is also used in shipping and power generation.

Smaller imports of Russian crude in the wake of Moscow’s output cuts means India has less to refine into dirty products — prompting it to ship in more of the feedstocks from Russia. Upcoming maintenance at Indian refineries may also impact its sludgy fuels production, another reason why it’s importing more now.

“It appears that there’s a strong build-up of Russian fuel oils exports to India,” said Andon Pavlov, lead analyst for refining and dirty products at Kpler. “This might have to do with the upcoming refinery maintenance in India, set to put a lid on total primary processing capacity over September-October.”

A drop in primary refinery unit utilization may limit the production of residual fuels like vacuum gasoil and fuel oil among other products. India’s complex refiners can still use these dirty fuels in their secondary units to be upgraded to clean products like diesel and gasoline.

The jump in Russian flows are set to push India’s total imports of sludgy fuels from all regions to about 361,000 barrels a day this month, also the most in data going back to early 2017. The figure is likely to be revised higher if more cargoes are observed for the month from nearby suppliers.

India’s crude imports from Russia and other OPEC+ members like Saudi Arabia have shrunk in recent months amid voluntary production cuts by the bloc. This has tightened Indian refiners’ access to fuel oil-rich varieties of heavy or medium sour crudes, reducing the feedstock to their upgrading units that optimize clean fuel output.

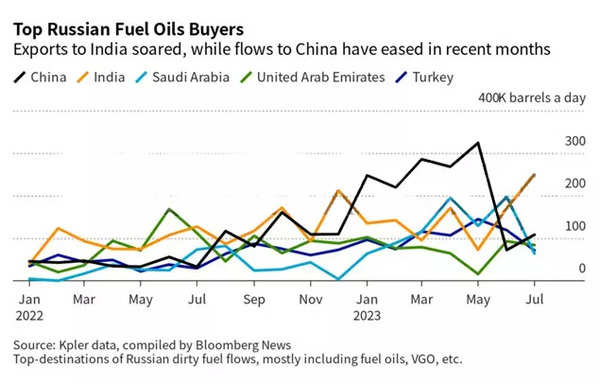

Most of the shipments expected to arrive in India this month sailed from Russia’s ports in July. Russian fuel oil flows rebounded last month, with India emerging as the top destination. Meanwhile, Russian fuel oil exports to China in recent months were much lower than earlier in the year.

That could partly be due to high processing rates in Russia and tepid VGO buying interest across the East, according to Pavlov. “China is increasingly switching to higher full crude conversion at home,” he said.

Another reason why India is importing more dirty fuels from Russia is because road-fuel demand is expected to see a robust recovery beyond the monsoon season, Pavlov said.