Gilt Funds: How staggered investment in these debt mutual funds can help you earn inflation beating returns – Times of India

[ad_1]

Fund managers believe that this presents an opportunity for long-term fixed-income investors, as investments in such funds with a two- to three-year view could yield returns of around 200 basis points above inflation.

Sandeep Bagla, the chief executive at Trust Capital, suggests that the current 10-year benchmark yield of over 7% is an attractive opportunity for long-term fixed-income investors to gradually invest in long-tenure funds over the next four to six months. This strategy will not only help beat inflation but also allow for capital appreciation when interest rates decline.

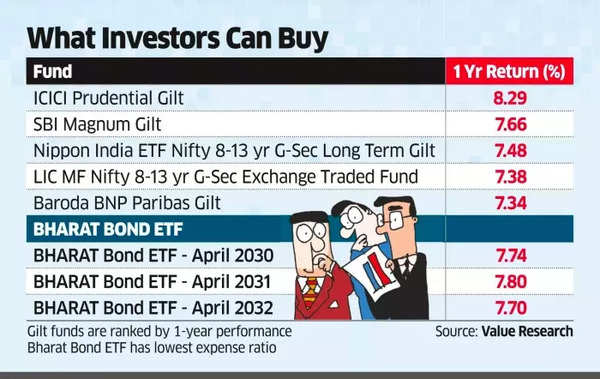

Gilt Funds Investors Can Buy

However, fund managers caution that near-term rates may be volatile and could slightly increase due to the RBI’s indication of open market operations to manage liquidity. The 10-year benchmark yield has already risen by 13 basis points to 7.38%. In the previous quarter, the yield had only increased by 20 basis points.

According to Franklin Templeton Mutual Fund, the easing rate cycle is expected to begin in the fourth quarter of calendar 2024, with shallow cuts, as core inflation remains stubborn and growth moderates.

Fixed Income Mutual Funds Vs Fixed Deposits: What should you do in high interest rate scenario?

Puneet Pal, the head of fixed income at PGIM India Mutual Fund, predicts that the 10-year benchmark yield will fluctuate between 7.25% and 7.60% in the coming months. Pal believes that yields are entering an attractive territory and suggests that investors increase their allocation to fixed income at the longer end of the curve, particularly in funds with a duration of 3-4 years and predominantly sovereign holdings.

Ashish Shanker, the CEO of Motilal Oswal Wealth, agrees that yields are close to their peak and recommends long-tenure gilt funds such as the Bharat Bond ETF that matures in 2030 or the Nippon Nivesh Lakshya fund that invests in long-tenure government bonds. He believes that investors with a three-year view should consider these options.

Gold Buying Tips: Sovereign Gold Bonds Vs Gold ETFs, Gold MFs Vs Gold Coins, Bars, Jewelry Explained

Financial planners also prefer G-sec funds over corporate bond funds due to the narrow spread between AAA-rated bonds and G-secs. Rupesh Bhansali, the head of distribution at GEPL Capital, advises investors to stagger their investments into gilt funds over the next three to six months, particularly target maturity funds that mature between 2026 and 2030 or Gilt funds.

[ad_2]