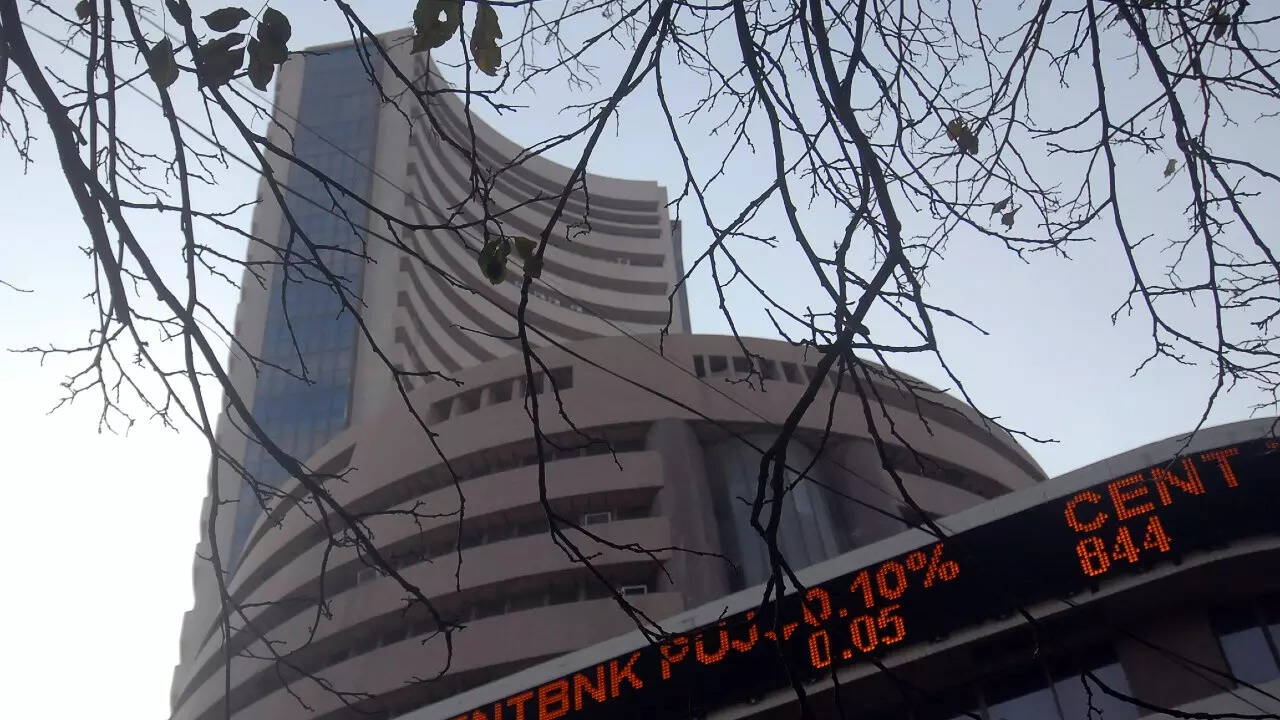

Sensex & Nifty rebound! Markets bounce back after 6 days of fall – Times of India

[ad_1]

According to an ET report, major sectoral indices all recorded gains, with high-weightage banks, financials, and IT sectors rising by 0.6%, 0.7%, and 0.8%, respectively.Metal, realty, media, and auto sectors saw increases of over 1% each. Small and mid-cap stocks, which are more domestically focused, rose by 1.8% and 1.5%, respectively.

Among the Sensex stocks, Infosys, Tata Steel, M&M, NTPC, SBI, and Wipro opened with gains, while only Asian Paints, UltraTech Cement, and HUL saw losses. Karnataka Bank’s stock rose by 5% after the bank’s board approved an allotment of Rs 800 crore on a preferential basis. Vodafone Idea’s shares traded nearly 3% higher, despite its consolidated net loss widening to Rs 8,738 crore in Q2 FY24 from Rs 7,595 crore in Q2 FY23.

The US economy experienced robust growth in the last quarter, reaching its swiftest pace in almost two years, propelled by a surge in consumer spending.

According to the government’s initial assessment on Thursday, Gross Domestic Product (GDP) accelerated to an annualized rate of 4.9%, more than double the pace in the second quarter. Personal spending, the primary driver of economic growth, also saw a significant increase of 4%, marking the highest level since 2021.

On Friday, Asian shares followed the positive trend of Wall Street futures, driven by relief from Amazon’s earnings report. S&P 500 futures increased by 0.4%, and Nasdaq futures surged by 0.7%, primarily due to a 5% rise in Amazon shares during after-hours trading.

The Nikkei in Tokyo recorded a 1% rise, although it was still down by 1.2% for the week. China’s blue-chip stocks remained stable, while Hong Kong’s Hang Seng index experienced a substantial 1% surge.

According to VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, the US GDP growth data was surprising. “The Q3 GDP growth at 4.9% means the Fed will continue to be hawkish and the likely ‘higher for longer’ interest rate regime is negative from the stock market perspective,” he said.

According to Vijayakumar, from an India perspective, it’s the time for cherry picking for long-term investors.