Diwali dhamaka: A dozen IPOs to hit Dalal Street soon despite Sensex & Nifty bloodbath – Times of India

[ad_1]

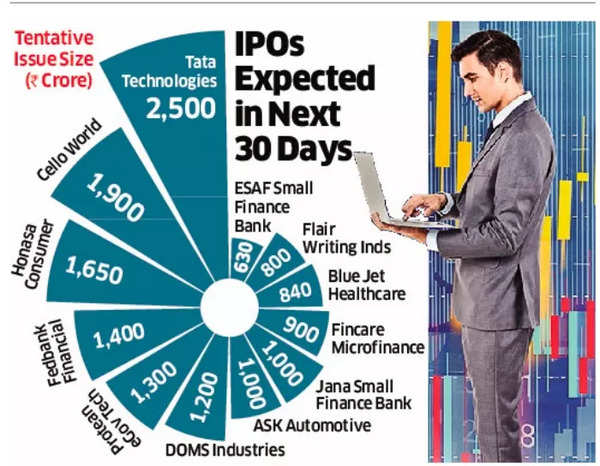

Cello World, Mamaearth and Blue Jet Healthcare have already disclosed their IPO dates, while others such as Tata Technologies, ASK Automotive, Protean eGov Technologies, Fedbank Financial Services, ESAF Small Finance Bank, Flair Writing Industries, and Credo Brands Marketing are in the pipeline.Cello World’s Rs 1,900 crore public offering, a prominent player in consumer houseware, writing instruments, and stationery, will be open for public subscription from October 30 to November 1, with a price band set at Rs 617-648 per share. Meanwhile, Blue Jet Healthcare’s Rs 840 crore IPO will remain open until October 27.

The much-anticipated public issue of Tata Technologies, the first from India’s largest conglomerate, the Tata Group, in nearly two decades, is expected to debut in the second or third week of November. Tata Technologies’ IPO, with an expected pricing range of Rs 450 to Rs 500 per share, is estimated to hold a premium of approximately Rs 240 in the unofficial market.

Tata Motors, the company’s promoter, intends to sell a 9.9% stake in Tata Technologies for Rs 1,613.7 crore to TPG Rise Climate SF Pte and the Ratan Tata Endowment Foundation (RTEF).

IPOs expected in next 30 days

Bankers have reported strong interest from institutional investors during roadshows for high-caliber companies.

In volatile market conditions, robust institutional demand continues to be evident during roadshows, stated Atul Mehra, Joint Managing Director of JM Financial. High-quality companies find strong support for fundraising, indicating a steady demand for such offerings, he said.

Honasa Consumer, the parent company of Mamaearth, is set to launch its public issue next week to raise approximately Rs 1,650 crore. The IPO consists of a fresh issue of Rs 400 crore and an offer for sale of 46.8 million existing shares.

Non-banking finance firm Fedbank Financial Services, backed by Federal Bank, will initiate its Rs 1,400 crore public issue next month, including a fresh issue of up to Rs 750 crore and an offer for sale totaling 70.3 million shares by promoters and other shareholders.

Despite a decline in the Nifty and Nifty Midcap100 indices over the past week due to geopolitical uncertainties and rising US bond yields, primary market conditions appear less affected by the subdued secondary market, according to bankers.

Many IPOs hit Indian stock markets: Should you invest? FAQs Answered | IPO Investment Guide

The primary market’s fundraising activity remains unaffected by the recent secondary market volatility. IPO pricing strategies have been designed to factor in these developments, providing a cushion against market fluctuations, according to V Jayashankar, head of investment banking at Kotak Capital.

Protean eGov Technologies, previously known as NSDL e-Governance Infrastructure, is gearing up for an IPO in November with the aim of raising approximately Rs 1,200-1,300 crore.

ASK Automotive, a manufacturer of motorcycle, scooter, and commercial vehicle components, is also making preparations to enter the capital market with a planned offering of Rs 1,000 crore next month.

In 2023, 36 companies have collectively raised Rs 28,330 crore, in contrast to the Rs 59,302 crore raised by 40 entities in 2022. Out of the 37 IPOs this year, only two are trading below their offer price. Notably, four companies, namely Cyient DLM, Plaza Wires, Utkarsh Small Finance Bank, and Senco Gold, have witnessed their value more than double, while another 14 have generated returns ranging from 30% to 80%.