BSE Sensex, Nifty50 end at record highs: How much steam is left in stock market rally & where should you put your money? Find out – Times of India

[ad_1]

The stock market rally is largely led by strong macroeconomic data and the Bharatiya Janata Party’s (BJP) massive wins in the recent state elections.BSE Sensex has moved up by as much as 1,700 points in just two trading sessions onDalal Street.

According to Shiv Sehgal, President and Head at Nuvama Capital Markets, Indian markets are an outlier when it comes to most global indices. “Nifty has seen a strong resurgence – scaling fresh highs. It’s perhaps one of the few indices in the world which have scaled fresh highs in 2023,” Sehgal tells TOI.

More importantly, he points to the broad-based nature of the rally. “Those oriented towards domestic growth, especially capex, are doing exceedingly well. This again is an outlier, where globally the rally is narrow and restricted to just few stocks with broader markets significantly underperforming. Such a strong rally is essentially a function of strong domestic fundamentals and the rising equity cult,” he said.

Where is Nifty headed? Where should you put your money?

How much steam is left in the stock market rally? Market experts expect the Indian markets to move up in the coming months ahead of the Lok Sabha polls 2024.

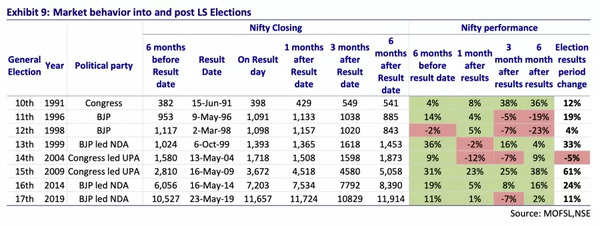

Gautam Duggad, Research Analyst at Motilal Oswal Financial Services sees the market sentiment strengthening further. “The prospect of a pre-election rally is quite strong now, in our view. We also note that Nifty has given positive returns (9%-36%) six months into the announcement of general election results (Nov to May) on five previous such occasions (1999-2019),” Duggad said.

Market behaviour into and post Lok Sabha elections

Motilal Oswal has listed BFSI, Industrials, Real Estate, Auto and Consumer Discretionary in their preferred sectors list.

Gaurav Dua, Head – Capital Market Strategy, Sharekhan by BNP Paribas expects the Nifty50 rally to continue in the run up to the general elections. “Nifty could add 1,000-1,200 points from the current level in the run up to the national election,” Dua tells TOI.

He believes that the rally could be led by PSUs, infrastructure & engineering, banking and select consumer stocks. On the other hand, we continue to remain cautious on IT services and metals space, he says.

On the other hand, Sehgal of Nuvama says that some consolidation is expected in the coming months. “Going ahead, while there could be some consolidation in markets in the near term given the strong rally, we think long term fundamentals remain strong,” he tells TOI.

Sehgal is of the view that over the long term, domestic cyclicals should provide the maximum shareholder value. “Sectors like banks, industrials, and discretionary consumption should provide healthy returns,” he says.