Sachin Tendulkar, TVS group family, Infosys co-founder Kris Gopalakrishnan invest in FirstCry ahead of its IPO – Times of India

[ad_1]

This move opens up opportunities for more family offices and individuals to invest in the firm.Among those purchasing stakes in FirstCry are the family offices of Indian cricketer Sachin Tendulkar, Ravi Modi of ethnic wear brand Manyavar, Infosys co-founder Kris Gopalakrishnan, and the TVS group family, according to an ET report. The total secondary share sale leading up to next year’s planned public listing now exceeds Rs 1,000 crore.

FirstCry IPO

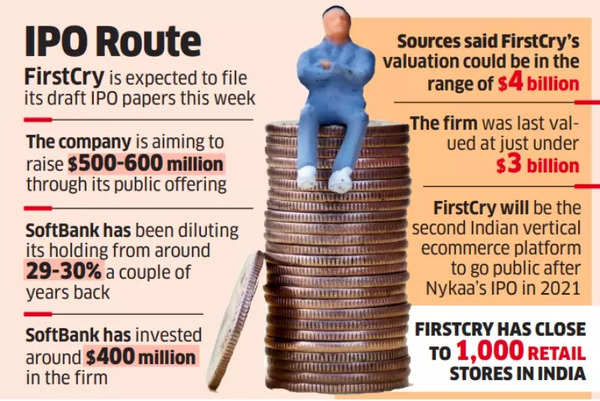

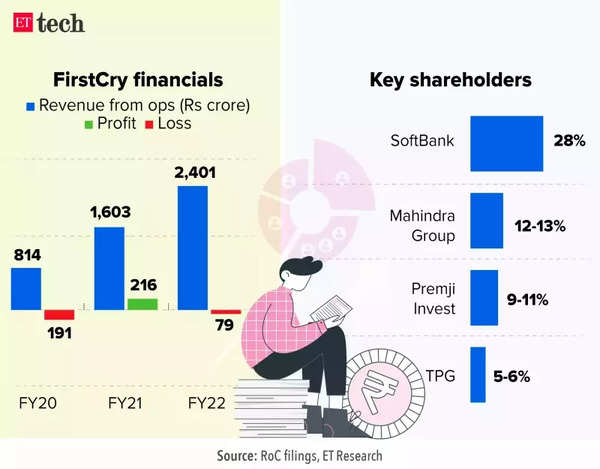

According to insiders, SoftBank has sold shares worth around Rs 600 crore, reducing its stake in the company to below 25%. This dilution follows a gradual decrease from SoftBank’s initial holding of approximately 29-30% a few years ago. The financial daily reported in December that FirstCry is expected to file its draft IPO papers this week, with a goal of raising $500-600 million through the offering.

Earlier this year, Ranjan Pai (Manipal Group), Harsh Mariwala’s (Marico) investment office Sharrp Ventures, and Hemendra Kothari’s DSP family office also acquired shares in FirstCry. SoftBank has invested approximately $400 million in the company and has already earned close to $300 million from its investment. If FirstCry goes public with a valuation of $4 billion or more, SoftBank’s remaining stake could still be worth $1 billion, according to a person aware of the matter.

Although FirstCry has not disclosed its valuation for the IPO, sources suggest it could be in the range of $4 billion. The company was last valued at just under $3 billion. Both FirstCry and SoftBank declined to comment on the matter.

FirstCry Financials

It’s important to note that in a secondary share sale, existing investors sell their stakes to new investors, and the capital does not go to the company itself. On the other hand, in a primary share sale, new shares are issued, and the company raises funds through that process.

FirstCry’s IPO is expected to have 35-37% of the offer in primary share sale, while the remaining portion will be in secondary share sale, also known as an offer for sale (OFS).

New investors, such as Premji Invest (the family office of Wipro founder Azim Premji) and the Mahindra group, are joining FirstCry’s cap table. FirstCry will be the second Indian vertical e-commerce platform to go public, following Nykaa’s IPO in 2021. The Pune-based company specializes in selling products for children and mothers through both online and offline channels. It is on the verge of reaching 1,000 retail stores across India. FirstCry also operates a subsidiary called Globalbees, which focuses on e-commerce roll-ups.

FirstCry was founded in 2010 by Supam Maheshwari, Sanket Hattimattur, Amitava Saha, and Prashant Jadhav. Maheshwari and Hattimattur serve on the company’s board, while Saha runs Xpressbees, a logistics firm that spun off from FirstCry. Nitin Agarwal is the chief executive of Globalbees.