Bank Deposits Losing Sheen? Why More Savers Are Moving to Higher-Yielding Investment Options Like Mutual Funds, Stocks | India Business News – Times of India

[ad_1]

The rise of technology and the increasing familiarity with Dalal Street (the Indian stock market) among rural savers are further intensifying the struggle for deposits in the banking industry.This democratization of technology is fundamentally changing the dynamics of financial savings, to the disadvantage of traditional high-street banks.

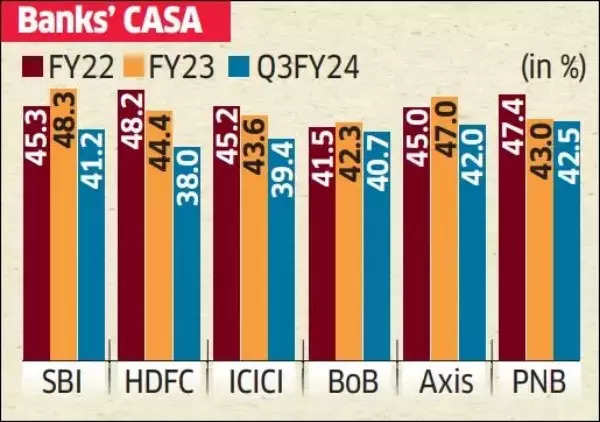

As of September 2023, the collective CASA ratio (current and savings account deposits) of all commercial banks in India stands at 40.5%, down from 43.1% in March 2023 and 45.2% in March 2022. This is a decline of nearly 5 percentage points in 18 months, according to an ET report.

Banks’ CASA

One of the reasons for the decline in CASA ratios could be the increase in bank fixed deposit rates. State Bank of India’s CASA ratio dropped to 41.18% as of December 31, 2023, a decline of 330 basis points compared to the previous year.

P R Rajagopal, executive director of Bank of India, highlighted the shift in savings patterns, particularly in urban areas. Digitization has provided savers with access to alternative savings products like mutual funds, reducing their reliance on banks for deposits.

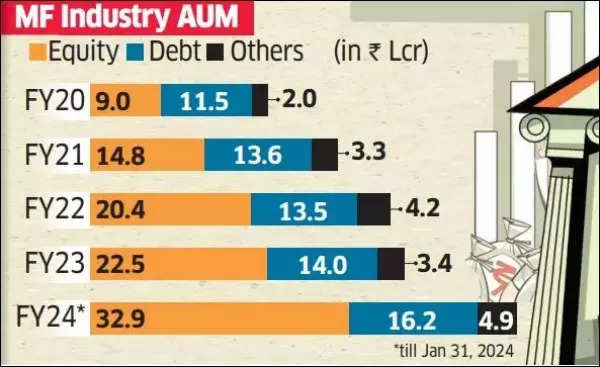

The latest data from the Association of Mutual Funds in India (AMFI) reveals a surge in inflows into equity mutual funds. In January, inflows reached a 22-month high of Rs 21,781 crore, marking the 35th consecutive month of net inflows. Additionally, assets under management in the pooled funds industry increased to Rs 52.74 lakh crore.

MF Industry AUM

Furthermore, the total number of SIP accounts, enabling savers to methodically allocate their excess funds into mutual funds, rose to 79.20 million in January 2024, with the inclusion of 5.18 million new SIP accounts during the month.

The decline in CASA is more pronounced in private sector banks, as their younger customer base is more comfortable with technology and seeks higher returns. The share of CASA deposits in private sector banks decreased to 39.9% by the end of December 31, 2023, compared to 44.5% a year ago.

Dinesh Khara, Chairman of State Bank of India (SBI), acknowledged that banks’ CASA ratio is returning to pre-Covid levels as people resume their spending habits. He also noted that savers tend to allocate their funds to higher-yielding assets during inflationary periods. However, Khara emphasized that banking remains the primary channel through which money flows into mutual funds, life insurance, and pension funds, giving banks an advantage.

The credit-deposit ratio of Indian banks reached a two-decade high of 80% in December 2023. While credit growth exceeds the nominal pace of GDP growth, deposits are only increasing in line with the nominal GDP. This shift of savings towards other asset classes, such as mutual funds, equity investments, and real estate, is causing a deterioration in the loan-to-deposit ratio (LDR) levels, states a recent S&P Global Ratings report.

Public sector banks are also facing challenges as they no longer receive large floating deposits from corporate and government accounts. Current account deposits are no longer bulky, as companies actively manage their treasuries and keep less money in their accounts. Additionally, the government now provides ministries with budgeted allocations on demand, rather than upfront. These structural changes make deposit gathering more challenging for banks, believes Rajagopal from Bank of India.

Furthermore, the popularity of sweep deposits, offered by some private banks, is diverting funds from salary accounts. Sweep deposits provide easy liquidity terms and attract a significant amount of money.

Madan Sabnavis, chief economist of Bank of Baroda, mentioned that the concept of sweep deposits is more prevalent in private banks. Customers, both from public sector and private sector banks, may also be shifting their funds to mutual funds.