Rising valuations spur foreign firms to sell holdings in India – Times of India

[ad_1]

At least seven firms including US home appliance giant Whirlpool Corp and Singapore Telecommunications Ltd, have reduced holdings in their local units since June, data compiled by Bloomberg show. British American Tobacco Pl. said Monday it’s preparing to sell a part of its stake in partner ITC Ltd.

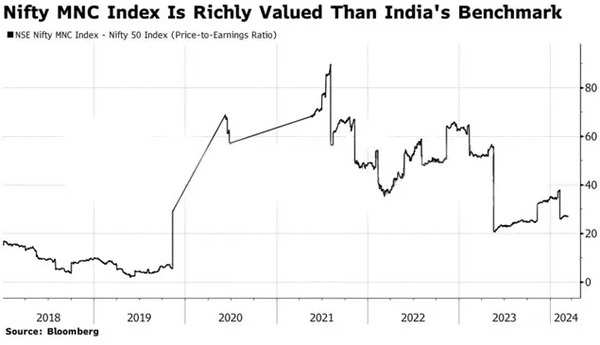

The companies are seeking to capitalize on India’s equity valuations which are among the most expensive in the world after eight years of annual gains. Analysts say these transactions contribute to increasing public shareholding, creating space for large investors to boost their holdings in the $4.5 trillion market.

“The easy monetization of stakes in Indian companies at current valuations show the market is becoming more mature amid rising support from domestic financial investors,” said Deven Choksey, managing director of DRChoksey FinServ Pvt.

Whirlpool slashed its stake in the Indian unit from 75% to 51% last month and said it plans to use the proceeds of about $468 million to reduce debt. Singtel plans to use funds to invest in areas such as data centers, according to exchange filings.

British American Tobacco has been speaking with Bank of America Corp. and Citigroup Inc. about a potential divestment of about $2 billion to $3 billion in ITC shares through block trades, according to people with knowledge of the matter.

The last major exit was in 2022 by cement maker Holcim AG when it sold its India business to Adani Group in a deal worth about $11 billion.

India’s main stock gauges have risen to new records, as continuous purchases by domestic investors helped offset net sales by foreigners.

Global funds have withdrawn a net $459 million from domestic shares since January 1, while Asian peers such as South Korea and Taiwan have each received inflows of more than $8.4 billion.

A gush of cash into mutual funds has helped cushion the nation’s equities against the outflows. Equity assets with local money managers rose to a record $277 billion in February, with flows to recurring stock investment plans reaching a new monthly high of $2.4 billion.

The market’s resilience when some controlling shareholders are selling “is good news for funds, who are looking to raise and deploy more money in India,” said Sachin Mehta, a director of investment banking at Anand Rathi Advisors.