GST collections for March 2024 hit second-highest record level of Rs 1.78 lakh crore; FY24 mop up crosses Rs 20 lakh crore – Times of India

[ad_1]

This increase was primarily fueled by a significant uptick in GST collection from domestic transactions, rising by 17.6%.The net GST revenue, after refunds, stood at Rs 1.65 lakh crore for March 2024, reflecting an 18.4% growth compared to the same period last year.

The full year total gross GST collection surpassed Rs 20 lakh crore, representing an 11.7% increase over the previous fiscal year. The average monthly collection for FY 2023-24 stood at Rs 1.68 lakh crore, exceeding the previous year’s average of Rs 1.5 lakh crore, the release said.

The net GST revenue, excluding refunds, reached Rs 18.01 lakh crore as of March 2024 for the current fiscal year, indicating a growth of 13.4% over the same period last year.

Positive trends were observed across various components of GST collection for March 2024. The breakdown includes:

- Central Goods and Services Tax (CGST): Rs 34,532 crore

- State Goods and Services Tax (SGST): Rs 43,746 crore

- Integrated Goods and Services Tax (IGST): Rs 87,947 crore, including Rs 40,322 crore collected on imported goods

- Cess: Rs 12,259 crore, including Rs 996 crore collected on imported goods

Similar positive trends were evident in the overall collections for FY 2023-24:

- Central Goods and Services Tax (CGST): Rs 3,75,710 crore

- State Goods and Services Tax (SGST): Rs 4,71,195 crore

- Integrated Goods and Services Tax (IGST): Rs 10,26,790 crore, including Rs 4,83,086 crore collected on imported goods

- Cess: Rs 1,44,554 crore, including Rs 11,915 crore collected on imported goods

In March 2024, the Central Government settled Rs 43,264 crore to CGST and Rs 37,704 crore to SGST from the IGST collected. This resulted in total revenues of Rs 77,796 crore for CGST and Rs 81,450 crore for SGST after regular settlement. For FY 2023-24, the central government settled Rs 4,87,039 crore to CGST and Rs 4,12,028 crore to SGST from the IGST collected.

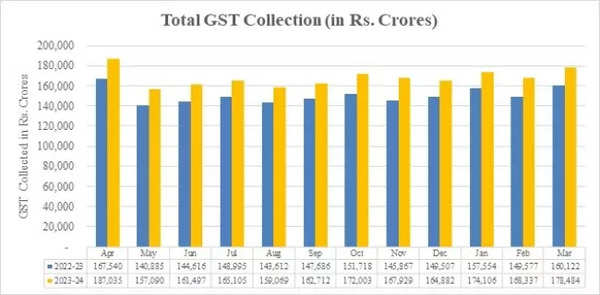

Trends in monthly gross GST revenues

The above chart depicts the trends in monthly gross GST revenues.

According to Abhishek Jain, Indirect Tax Head & Partner, KPMG, A 17.6 percent growth in collection in March from domestic transactions indicates strong domestic economic growth and adds significant cheer to the overall increased collections. “Also, the average monthly collections increasing by approximately 18000 crores this year indicates robust growth story and recovery,” he says.