RBI defers exchange-traded currency derivatives rules – Times of India

[ad_1]

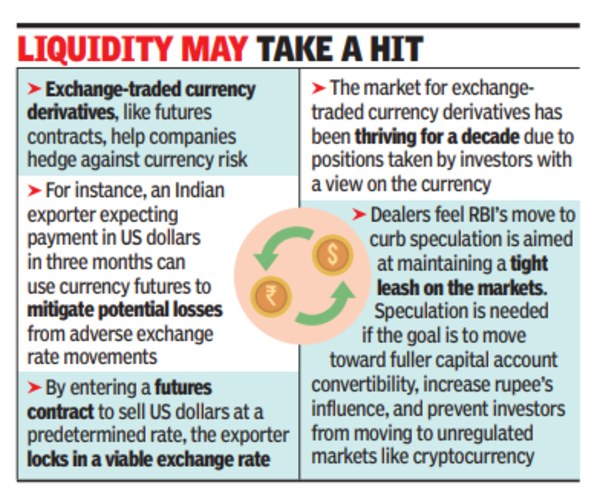

RBI’s circular, which was scheduled to come into effect on April 5, said that only traders with an underlying forex exposure can trade in currency derivatives. Exchange-traded currency derivatives, like futures contracts, help companies hedge against currency risk.For instance, an Indian exporter expecting payment in US dollars in three months can use currency futures to mitigate potential losses from adverse exchange rate movements. By entering a futures contract to sell US dollars at a predetermined rate, the exporter locks in a viable exchange rate.

The market for exchange-traded currency derivatives has been thriving for a decade because of positions taken by investors with a view on the currency. However, RBI said that its recent circular only reiterates its existing position. “The regulatory framework for exchange-traded currency derivatives has remained consistent over the years, and there is no change in RBI’s policy approach,” it said.

The circular, issued on Jan 5, retained most of the earlier regulations, including a requirement that trades over $100 million would require proof of exposure. This requirement of proof for higher value trades was being interpreted by participants to mean that those who did not have any exposure could participate in lower value transactions. However, the Jan 5 circular carried a footnote requiring exchanges to ask clients to trade only against exposures.

Dealers feel that RBI’s move to curb speculation is aimed at maintaining a tight leash on the markets. However, speculation is needed in a market if the objective is to move toward fuller capital account convertibility, increase rupee’s influence globally, and prevent investors from moving to unregulated markets like cryptocurrency.

Traders said that the note effectively closed doors for speculative trades. “RBI in a circular on Jan 5, 2024 stated that forex derivative contracts involving the rupee can only be offered ‘for the purpose of hedging contracted exposure’… Effective April 5, proprietary traders and retail investors will be required to demonstrate contracted or prospective currency exposure to participate in the currency derivatives segments provided by the exchanges,” HDFC Securities wrote to its customers this week.

HDFC Securities’ communication asked customers to square off all existing open positions by Thursday and said only clients having valid underlying exposure proof are allowed to trade in the currency segment. Online stockbroker Zerodha issued a similar note to customers.