UK economy finds reverse gear with surprise decline in October

[ad_1]

The UK economy took a surprise tumble in October, according to an early official estimate that showed a contraction of 0.3%.

The Office for National Statistics (ONS) reported that output in all three main divisions – services, manufacturing and construction – was in negative territory.

Economists had expected a flat performance, following on from the 0.2% growth seen in September.

That meagre figure helped the economy to zero growth for the third quarter of the year, easing concerns over the prospect for a recession which is realised if a country records two consecutive quarters of contraction.

Nevertheless, the latest data builds on expectations of a largely flat performance ahead, despite a series of growth measures announced by the chancellor in his autumn statement last month.

Jeremy Hunt said of the ONS figures: “”It is inevitable GDP (gross domestic product) will be subdued whilst interest rates are doing their job to bring down inflation.”

Action taken by the Bank of England since December 2021 to tame inflation was intended to hit demand in the economy, helping the pace of price growth ease.

While the rate of inflation has slowed considerably from the figure above 11% seen just over a year ago, prices are still rising but just at a steadier pace.

The effect of interest rate hikes imposed by the Bank has added to borrowing costs, with rising mortgage and rent bills becoming a key plank of the cost of living crisis.

The Bank warned earlier this month that five million households were yet to feel the home loan hit because their fixed terms had not expired.

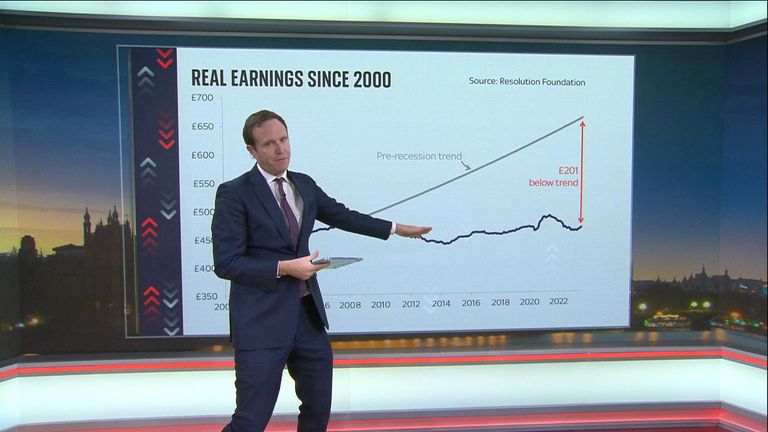

Household spending power has, to some extent, been propped up by a record pace for wage growth but data on Tuesday showed sharp falls in the levels of awards.

Consumers were still, however, enjoying the best real wage growth – when inflation is accounted for – for two years due to the steep easing in the inflation rate in October.

The Bank’s monetary policy committee has seen enough progress in bringing inflation down to have kept Bank rate at 5.25% for two consecutive meetings.

It is due to outline its next rate decision on Thursday, with financial markets and economists widely expecting a further pause.

ONS director of economic statistics, Darren Morgan, said of Wednesday’s data: “Our initial estimates suggest that GDP growth was flat across the last three months.

“Increases in services, led by engineering, film production and education – which recovered from the impact of summer strikes – were offset by falls in both manufacturing and housebuilding.

“October, however, saw contractions across all three main sectors. Services were the biggest driver of the fall with drops in IT, legal firms and film production – which fell back after a couple of strong months.

“These were also compounded by widespread falls in manufacturing and construction, which fell partly due to the poor weather.”

Shadow chancellor Rachel Reeves said: “Rishi Sunak ends the year having failed to deliver on his own promise to grow the economy.

“Economic growth is going backwards leaving working people worse off,” she said.

[ad_2]