2024 Automotive Materials Forecast: EV batteries…and more

[ad_1]

Entering 2024, automotive sector health shows mixed

messaging, fractured markets, and significant implosive forces

affecting major megatrends. For all four CASE systems (Connected,

Automated, Shared, and Electrified), 2023 showed cracks in the

expansion rates and long-term outlooks of these development focus

areas. But where does battery raw materials acquisition by OEMs and

suppliers fit into the picture?

As market level indicators such as interest rates, loan to

value, loan delinquency, and return to market all show headwinds –

OEM messaging has changed from confident expansion toward one of

value proposition. Suppliers with excessive debt coming to term

will need to rebalance their near-term strategy toward making

payments on increased interest rates instead of long-term

investments.

Underpinning all OEMs and Tier 1 suppliers are material supply

chains that directly determine which efforts will succeed by

changing the economic feasibility, market reach, and technical

prowess of their investments.

EV Battery Raw Materials

For example, Rare Earth Elements underpin the magnets in many

electrical motors, improve the material characteristics of legacy

materials, and enable ubiquitous technology such as touch sensitive

displays. This one category of minerals development feeds many of

the advanced technology packages seen as luxurious or even simply

competitive by consumers.

But also under scrutiny is a relatively mundane mineral: copper.

The mining of copper is currently underinvested and pivotal within

energy transition efforts, but we’re already seeing tier 1

suppliers and OEMs looking to replace this material in electrified

vehicles. Battery bus bars and charging cables are moving toward

aluminum in a cycle long known to the infrastructure-based use

cases. In those applications, a 4:1 price ratio will drive material

changes to infrastructure builds, and vehicle-based applications

may see a similar tipping point. Teardown services are identifying

improvements in assembly and cost which come from this material

change.

The materials supply chain currently stands as the second major

blockade to mainstream battery electric vehicle adoption rates. The

mining sector faces a struggle to convince a widening ethical

investor base of its ESG credentials.

Investments and crossing the chasm

Due to some investors holding back commitment to the mining

sector it has not yet garnered the investment required in mineral

exploration and extraction to support a mainstream transition to

electric vehicles. For every voice proclaiming the future of

automotive to be electric, there remains a chasm in investment

which bolsters the validity of Main Street hesitancy toward EV

adoption. While industry experts, business leaders and marketers

all point toward battery electric vehicles, mainstream consumers

have yet to find the problem that electric vehicles solve in their

daily lives.

The timidity of institutional investors may come from the

realities of EV adoption rates in the market – especially in North

America. Or it may point to the difficulties in getting raw

material markets to move forward – a task that takes decades of

approvals and remains highly sensitive to market demand.

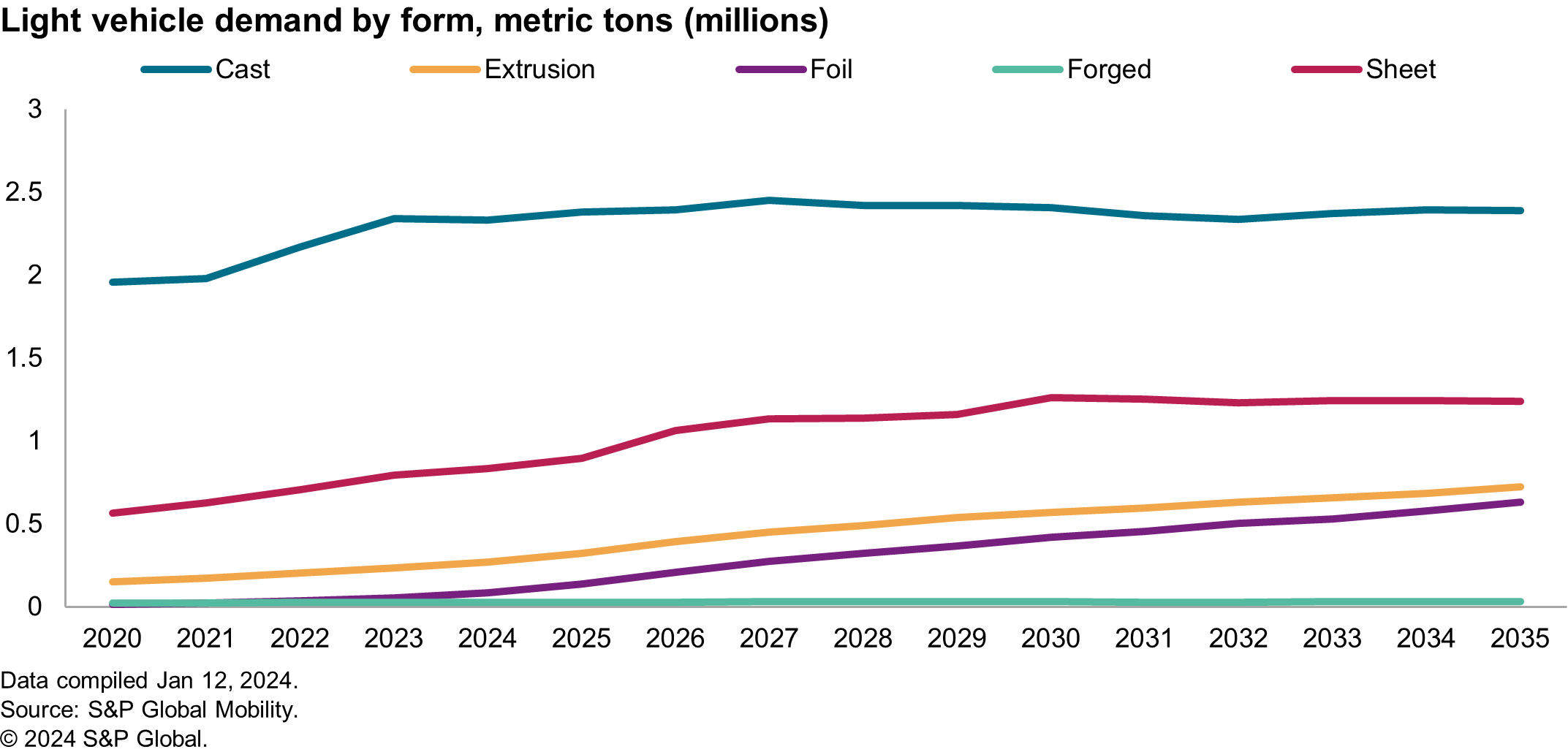

For instance, the chart below shows North American demand for

aluminum – a standard ingredient for the battery to live on, but

also a supply pinch point. Propulsion demand across multiple

components shifts from the lower value castings of traditional

systems towards extrusions, high-quality castings, and even foil

sheets. All these forms require aluminum with fewer impurities,

which influences scrap costs and may require dilution with

additional primary aluminum.

In 2023, the Platt’s Aluminum Symposium noted that high-quality

sources of aluminum recycling such as beverage cans would not be

able to bridge the demand gaps for North America, and the latest

trade deficit numbers reflect the accuracy of this prediction.

In primary markets there are still significant hurdles to

overcome in popularizing the re-processing of bauxite residue, also

known as red mud, and other mining waste to provide additional

market value with improved environmental impact. Low profit

margins, long duration payback, high planning risk, and high

sensitivity to operational excellence may be why investors have not

supported the minerals extraction market as much as may be

required. But it could also be baking in consumer-adoption

headwinds. Research conducted by S&P Global Mobility in in 2023

found expressed interest in refining tailings to extract high value

minerals while improving environmental <span/>stewardship, but voiced the difficulty in

finding investors.

Country Risk Assessment

In the last few years, several supply chain disruptions to major

material sources have fundamentally changed the way OEMs evaluate

the risk of accepting a new material within vehicles. And sometimes

the causes of supply chain snarls are unusual. As an example,

preparations for the winter Olympics in Beijing, mainland China

resulted in shortages in Magnesium (due to power plants being

forced to close around the event to comply with tougher clean air

rules which caused a reduction in smelting capacity). This

illustrated how the reliance on a single city for 80% of the global

supply of a commodity could result in shortfalls – causing

suppliers to frantically hunt for recycled materials.

Regional sourcing of materials such as Nickel, Manganese and

Cobalt have become more sensitized within OEMs. Some companies have

signed <span/>ESG

declarations regarding the origin of their material sourcing, to

avoid the brand-damaging effects of societal risks associated with

certain regions of production. Best-in-class materials may be

replaced by “best in risk aversion.”

Despite the sometimes cumbersome decision-making processes at

OEMs, alignment of cost and risk reduction can move quickly. With

the recent graphite shortfall of the battery industry, supply chain

localization efforts are looking further into the raw material

sourcing strategies to ensure risk is minimized.

ESG and Sustainability

For most people in business, “sustainability” usually concerns

the longevity of financials, product performance, and the reduction

of waste within systems. Messaging around sustainability has, in

some circles, become equivalent to carbon accounting.

Performance of materials in real-world conditions will be

contrasted with marketing messages and idealistic scenarios. For

engineers being asked to improve recycled material content in

components, reduce carbon footprint, or integrate biomaterials into

their components, the task is typically associated with cost

neutrality. But with the current macroeconomic conditions,

automotive product portfolios, and changing optics of high-level

initiatives, sustainability may evolve toward its initial

definition of overall environmental responsibility.

OEMs in Europe are currently working to meet recycled material

content regulatory requirements prior to formal approval. However,

there are major problems with the incumbent regulations from the

perspective of OEMs and material suppliers.

The EU mandate of recycled content is not a fine-based system,

but rather a compliance-based metric which will determine whether a

vehicle can be sold in the region. In cases of fine-based systems,

OEMs can tolerate a blended changeover plan whereby they may inch

toward compliance within a regulatory framework while accepting the

increased cost of doing business in the short term. However, in

this case, any vehicle with less than 25% recycled plastic will not

be permitted for sale in the EU market.

Component engineers are looking to their suppliers for recycled

content which can be quickly integrated into existing vehicles –

and this is a main friction point in the materials industry.

Chemical companies have existing recycled content compounds

available for commercial use, but they have not made it through

validation processes.

It’s possible the OEMs have not allocated enough budget for

these extensive and costly recertification processes, based on

S&P Global Mobility research within the supply base. One

component redesign researched was in the budget range of $50-80

Million, and these activities have slowed due to budgets being

reallocated to battery system development, according to the

supplier. Additionally, S&P Global Mobility has learned that

these material suppliers are highly reluctant to invest in new

processing systems that allow for integration of post-consumer

waste into the feedstock. Although it is a state-of-the-art

process, many of these publicly-traded suppliers are risking

profitability in the process.

Fully loaded or decontented?

While materials can be a geopolitical and regulatory risk, there

are unsung benefits of proper material selection when evaluated

from a bottom-up perspective.

Some groups view material selection as infrastructure: If it

works, a company will only invest the amount needed to keep the

wheels rolling. For others, material selection is the tip of the

innovation spear affecting customers directly. Use cases of

vehicles are the ultimate group of demographics, intersectionality,

and practicality.

Automakers make big investments in tactile surfaces, but

decontenting a vehicle with the removal of items such as carpet, or

using cloth or exposed non-woven surfaces, may produce a vehicle

that gives the impression of rugged luxury. For another consumer,

seeing a vehicle with an eco-conscious pledge of zero landfill

waste, biopolymer use, or metrics reflecting the amount of recycled

content, may align with their core values and emotional sentiment

of why they purchase the vehicle.

Materials priorities in the supply chain

So, are materials considered as infrastructure or innovation?

Both definitions are correct. Raw materials support the systems

groups formally labeled as infrastructure, possibly putting

minerals as the grandparents to these systems.

OEMs have attempted to secure the expansion portfolios in

lithium, foreseeing an undersupply of this mineral in comparison

with their product plans. However, this is not the only at-risk

material for OEMs, as geopolitical, compliance, and market

sentiment are dictating different terms. OEMs need to bring raw

material supply chains back toward assembly plants, improve the

material’s internal visibility, and keep inflationary pricing in

check.

The automotive industry is no stranger to complex systems,

logistical sensitivities, or even vertical integration. Many of the

stated goals for OEMs are currently competing for budget, talent,

and marketing attention.

2024 may show the priorities of OEMs in a competitive goals

environment, whereby single-metric grading scales are no longer

appropriate methods of gauging their market performance. Some

stretch goals of corporate performance may focus on core value

propositions, consumer needs, and profitability. Strong business

cases that embrace grit, efficiency gains, and waste reduction are

expected to be winning topics.

FOR MORE ON MATERIALS AND LIGHTWEIGHTING

FEATURES AND TECHNOLOGY BENCHMARKING

THE LOOMING EV SUPPLIER SHAKEOUT

AUTOMOTIVE PLANNING AND FORECASTING

COMPONENT FORECAST ANALYTICS

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

[ad_2]