RBI asks banks to check end use of card payments – Times of India

[ad_1]

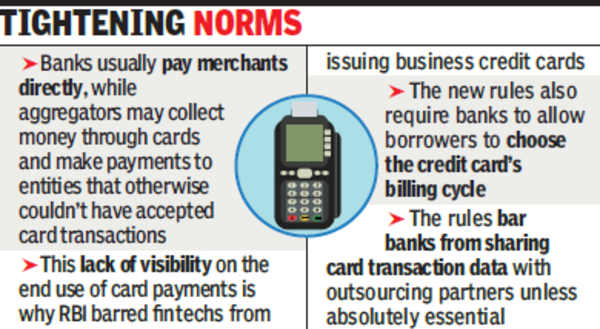

This lack of visibility on the end use of card payments was one of the reasons for RBI’s recent decision to bar fintechs from issuing business credit cards. This change is part of wider RBI card guidelines aimed at improving regulations following the entry of fintechs and aggregators. The new rules also require banks to allow borrowers to choose the credit card’s billing cycle.

The new rules bar banks from sharing card transaction data with outsourcing partners unless it is absolutely essential for the partner to discharge its functions. “In case of sharing any data as stated above, explicit consent from the cardholder shall be obtained. It shall also be ensured that the storage and the ownership of card data remain with the card-issuer,” the revised norms said.

There are also some relaxations. Banks and registered NBFCs can become co-branding partners without prior permission from the RBI. The revised provision reduces the period for reporting the default status to credit information companies from “within 30 days” to “within 30 days from the date of settlement”. Additionally, it underscores the significance of transparently adhering to procedures, especially in unresolved disputes.

The updated provision reinforces the instructions regarding issuing alternative form factors instead of traditional plastic debit/credit cards. It also introduces a new mandate for card issuers to offer mechanisms for disabling or blocking these form factors, aligning with directives from RBI.