China’s economic slump is sounding alarm bells across the world – Times of India

[ad_1]

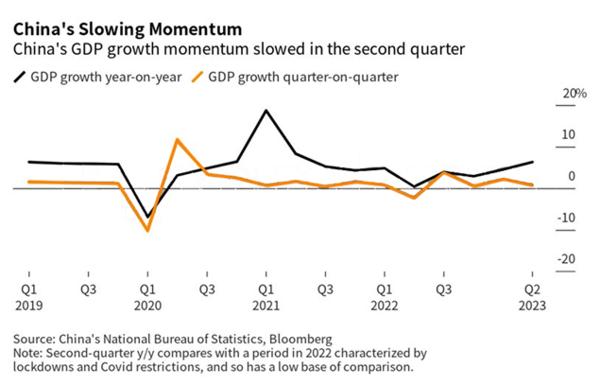

Policymakers are bracing for a hit to their economies as China’s imports of everything from construction materials to electronics slide. Caterpillar Inc says Chinese demand for machines used on building sites is worse than previously thought. US President Joe Biden called the economic problems a “ticking time bomb.”

Global investors have already pulled more than $10 billion from China’s stock markets, with most of the selling in blue chips. Goldman Sachs Group Inc and Morgan Stanley have cut their targets for Chinese equities, with the former also warning of spillover risks to the rest of the region.

Asian economies are taking the biggest hit to their trade so far, along with countries in Africa. Japan reported its first drop in exports in more than two years in July after China cut back on purchases of cars and chips. Central bankers from South Korea and Thailand last week cited China’s weak recovery for downgrades to their growth forecasts.

Not all doom-and-gloom

It’s not all doom-and-gloom, though. China’s slowdown will drag down global oil prices, and deflation in the country means the prices of goods being shipped around the world are falling. That’s a benefit to countries like the US and UK still battling high inflation.

Some emerging markets like India also see opportunities, hoping to attract the foreign investment that may be leaving China’s shores.

But as the world’s second-largest economy, a prolonged slowdown in China will hurt, rather than help, the rest of the world. An analysis from the International Monetary Fund shows how much is at stake: when China’s growth rate rises by 1 percentage point, global expansion is boosted by about 0.3 percentage points.

China’s deflation “isn’t such a bad thing” for the global economy, Peter Berezin, chief global strategist BCA Research Inc, said in an interview on Bloomberg TV. “But, if the rest of the world, the US and Europe, falls into recession, if China remains weak, then that would be a problem — not just for China but for the whole global economy.”

Here’s a look at how China’s slowdown is rippling across economies and financial markets.

Trade slump

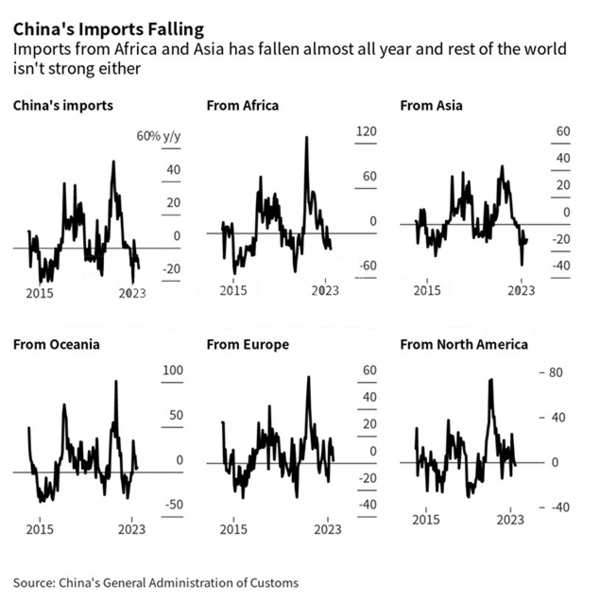

Many countries, especially those in Asia, count China as their biggest export market for everything from electronic parts and food to metals and energy.

The value of Chinese imports has fallen for nine of the last 10 months as demand retreats from the record highs set during the pandemic. The value of shipments from Africa, Asia and North America were all lower in July than they were a year ago.

Africa and Asia have been the hardest hit, with the value of imports down more than 14% in the first seven months this year. Part of that is due to a drop in demand for electronics parts from South Korea and Taiwan, while falling prices of commodities such as fossil fuels are also hitting the value of goods shipped to China.

So far, the actual volume of commodities such as iron or copper ore sent to China has held up. But if the slowdown continues, shipments could be impacted, which would affect miners in Australia, South America and elsewhere around the world.

Deflation pressure

Producer prices in China have contracted for the past 10 months, meaning the cost of goods being shipped from the country is falling. That’s welcome news for people around the globe still struggling with high inflation.

The price of Chinese goods at US docks has fallen every month this year and that is likely to continue until factory prices in China return to positive territory. Economists at Wells Fargo & Co. estimate that a ‘hard landing’ in China — which they define as a 12.5% divergence from its trend growth — would cut the baseline forecast for US consumer inflation in 2025 by 0.7 percentage points to 1.4%.

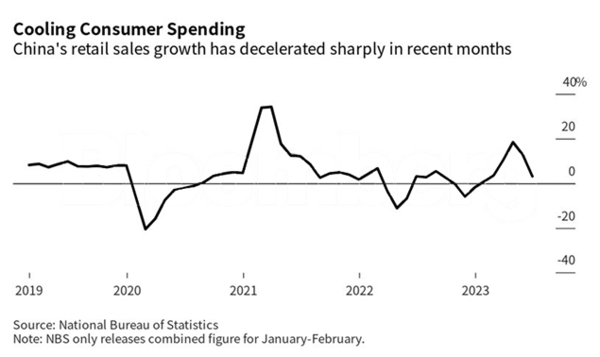

Chinese consumers are spending more on services, like travel and tourism, than on goods — but they’re not yet venturing overseas in large numbers. Until recently the government had banned group tours to many countries and there is still a lack of flights, meaning it’s much more expensive to travel than it was before the pandemic.

The pandemic and weak economy have curbed incomes in China, while the years-long housing market slump means homeowners feel less wealthy than before. That suggests it may take a long time for overseas travel to rebound to the levels they were at before the pandemic, hitting tourism-dependent nations in Southeast Asia such as Thailand.

Currency impact

China’s economic woes have pushed the currency down more than 5% against the dollar this year, with the yuan close to breaching the 7.3 mark this month. The central bank has escalated its defense of the yuan through various measures including its daily currency fixings.

The depreciation in the offshore yuan is having a greater impact on its peers in Asia, Latin America and the Central and Eastern Europe bloc, Bloomberg data show, with the correlation of the Chinese currency to some others rising.

The weak sentiment spillover may weigh on currencies like the Singapore dollar, Thai baht, and Mexican peso as correlations rise, according to Barclays Bank Plc.

“With the weaker China economy it’s very difficult to be optimistic on the Asian economies and currencies and we’re more concerned about the metal-exposed currencies,” said Magdalena Polan, head of emerging market macro research at PGIM Ltd. Weakness in the construction sector may see currencies of commodity-led economies, such as the Chilean peso and South African rand, suffer, she said.

The Australian dollar, which often trades as a proxy for China, has lost more than 3% this quarter, the worst performer in the Group-of-10 basket.

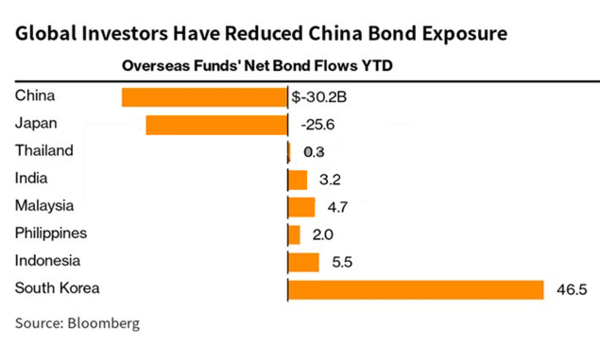

China’s interest rate cuts this year have reduced the appeal of its bonds to foreign investors, who have cut their exposure to the market and are looking for alternatives in the rest of the region.

Overseas holdings of Chinese sovereign notes are at the lowest share of the total market since 2019, according to Bloomberg calculations. Global funds had turned more bullish on the local currency bonds of South Korea and Indonesia as central banks there near the end of their interest-rate hiking cycles.

Companies from Nike Inc to Caterpillar have reported a hit to their earnings from China’s slowdown. An MSCI index that tracks global companies with the biggest exposure to China has retreated 9.3% this month, nearly double the decline in the broader gauge of world stocks.

A gauge of European luxury goods and Thailand travel and leisure also track losses to China’s onshore equity benchmark. The sectors are “accurate reflections of how global investors may take indirect exposure to China and the outlook as China’s economy continues to weigh,” said Redmond Wong, a market strategist at Saxo Capital Markets in Hong Kong.

Luxury goods firms such as Louis Vuitton bags-maker LVMH, Gucci-owner Kering SA and Hermes International are particularly vulnerable to any wobbles in Chinese demand.