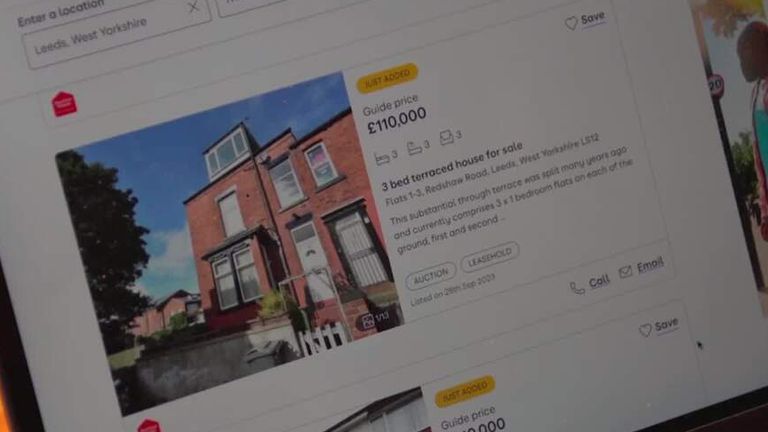

House price growth returns in October due to ‘constrained supply’ of properties

[ad_1]

House prices returned to growth in October, according to a closely watched measure that cited “constrained supply” of stock in the market.

Nationwide Building Society’s monthly index showed a 0.9% rise last month when compared to September’s flat performance, taking the annual rate to -3.3% from -5.3%.

Values have been hurt this year due to the impact of the continuing cost of living crisis and surge in borrowing costs imposed by the Bank of England to tackle inflation.

Robert Gardner, Nationwide’s chief economist, said housing market activity “remained extremely weak” as a result of the squeeze.

He cited figures from the Bank published on Tuesday that showed just 43,300 mortgages were approved in September, a figure that is around a third down on the pre-pandemic monthly average.

“This is not surprising”, he wrote, “as affordability remains stretched”.

“Market interest rates, which underpin mortgage pricing, have moderated somewhat but they are still well above the lows prevailing in 2021,” he said.

“The uptick in house prices in October most likely reflects the fact that the supply of properties on the market is constrained.

“There is little sign of forced selling, which would exert downward pressure on prices, as labour market conditions are solid and mortgage arrears are at historically low levels.

“Activity and house prices are likely to remain subdued in the coming quarters”, he concluded.

He made the prediction amid no sign of any major easing in mortgage costs for the foreseeable future.

The Bank of England is not expected by financial markets to begin interest rate cuts until late next year.

However, it is widely believed that Bank rate, at 5.25%, has perhaps reached its peak and policymakers are predicted to keep the rate on hold for the second successive time at its meeting this week.

This is due to signs that its earlier action, to help tame inflationary pressures in the economy, are working.

Its actions to date, while adding to mortgage bills for those on new fixed deals or those linked to Bank rate, have also resulted in a surge in rental prices due to the additional burden on landlords’ financing costs.

Again, a lack of supply is also placing further upwards pressure on private rents.

Nicky Stevenson, managing director at estate agent group Fine & Country, was more bullish on the prospect for house prices than Nationwide.

Read more from Sky News:

WeWork shares plunge on report of looming bankruptcy filing

Temporary accommodation spending ‘threatening to overwhelm council budgets’

Hedge fund to shut down after harassment claims against founder

She said: “House prices showed signs of recovery in October, finally gaining back some momentum after the summer lull and boosted by a pause in interest rates.

“The Bank of England’s surprising decision to hold off on a rate hike in September was a relief for hesitant buyers, who were waiting for economic stability before committing to a purchase.”

[ad_2]