Average rents hit another record high while house price falls ease off

[ad_1]

Average private rents rose at their fastest annual pace last month since comparable records began in 2015, according to official UK figures.

The data from the Office for National Statistics (ONS) showed no let up in the surging costs faced by renters since 2022.

It reported a leap of 9% over the 12 months to February in a provisional estimate, up from the 8.5% annual rate seen in January.

The ONS said that average UK house prices decreased 0.6% in the 12 months to January, to £282,000, noting an easing in the pace of decline.

Money latest: Reaction as UK inflation eases by more than expected

More recent industry data has suggested a return to price growth as mortgage rates have come down in anticipation of Bank of England interest rate cuts.

The upwards pressure on rents has come from demand hugely outstripping supply and landlords passing on to tenants the higher interest rates they are facing.

ONS deputy director for prices, Matt Corder, said: “Brent saw the highest annual rental growth of all local areas and Melton saw the lowest, while rental prices were highest in Kensington & Chelsea and lowest in Dumfries & Galloway.

“Average UK house prices continued to fall, albeit at a slower annual rate than seen recently.

“Indeed, Scotland’s average house prices rose at their fastest annual rate for more than a year.”

At a rate of 9%, the pace of rent increases is hugely outstripping inflation.

Read more:

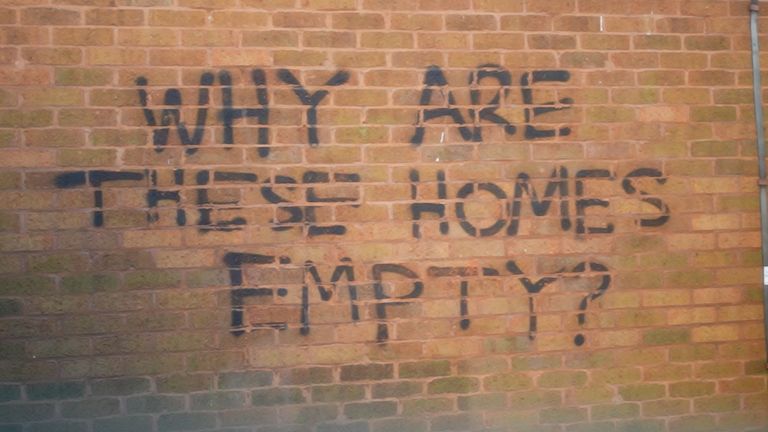

The seaside town where there are not enough homes to go round and the rental market is broken

Separate ONS data on Wednesday showed a slowing in the annual headline measure from 4% in January to 3.4% last month.

However, the prospects for Bank of England interest rate cuts still seem to be months away, as the figures will not have erased concerns among rate-setters about inflationary pressures ahead.

Hannah Bashford, director of model financial solutions, said of the ONS figures: “As shocking as this data is, it’s not a surprise as we have seen many landlords having to raise their rents to cover the increased interest costs and satisfy lenders’ affordability criteria.

“The rental market is broken and those that do not have mortgages are reaping the benefits of these hikes, while others are just about clinging onto their investments.

“These rents make it almost impossible to save for a deposit and so the circle continues”, she concluded.

[ad_2]