BriefCASE: Baltimore – Not another port in automotive’s stormy recent history

[ad_1]

As the world awoke on the morning of March 26 to the news that

there had been a crash involving a container ship and the Francis

Scott Key Bridge in the city of Baltimore, which had caused the

bridge to collapse, immediate thoughts were for the safety and

welfare of all concerned. Six people are missing, presumed dead in

the tragic aftermath.

Traffic through the port will be suspended until further notice and

looks set to disrupt to trade and supply chains. One of the sectors

that would likely be affected is automotive, particularly after the

disclosure that the Baltimore port is the biggest single hub for

trade in light vehicles in the US. Will the events at Baltimore be

the latest exogenous supply chain shock to join a long list of

events to disrupt the sector since the 2011 Fukushima nuclear

disaster?

To attempt to address this question, we undertook an analysis of

recent trade data for vehicles and parts provided by Panjiva, a

product of the S&P Global Market Intelligence division. Our

vehicle analysis focuses from the Jan. 1, 2024, to Jan. 31, 2024

time period to give a snapshot of vehicle tradeflows into the US.

Using the Harmonized System (HS) code 8703, which relates to cars

and motor vehicles mainly designed for personal transportation, we

scrubbed the data for products outside of the light-vehicle sphere,

such as golf carts and all-terrain vehicles (ATVs), and used

vehicles.

This process confirmed Baltimore’s crown as the leading port for

vehicle movement in the US. In the period under consideration, it

accounted for 15.2% of vehicle trade, nearly 5% ahead of its

nearest rival Brunswick, Ga. In terms of imported vehicle trade by

weight, Baltimore’s figure of nearly 117,000 tons equates to nearly

63,000 vehicles based on the average weight of new vehicles in the

US, according to an Environmental Protection Agency (EPA) study of

2022.

Delving deeper into data for Baltimore and looking at consignees

(those receiving the goods) based just in North America —

leaving out those vehicles where Baltimore is just a stopping-off

point before heading further afield to countries such as Australia,

New Zealand or South Korea — it is seen that Mazda is the

biggest customer of the port in terms of vehicle trade. Mazda first

signed a five-year contract with the Port of Baltimore back in

August 2013, making the port the hub for its northeastern

distribution.

Impact on supply chain

The level of disruption caused to vehicle shipments by Baltimore’s

shutdown is expected to be minimalized by a multitude of other

options being available to vehicle companies wanting to route their

vehicles to the US’ east coast. Brunswick; Newark, NJ; and

Philadelphia all provide viable alternatives.

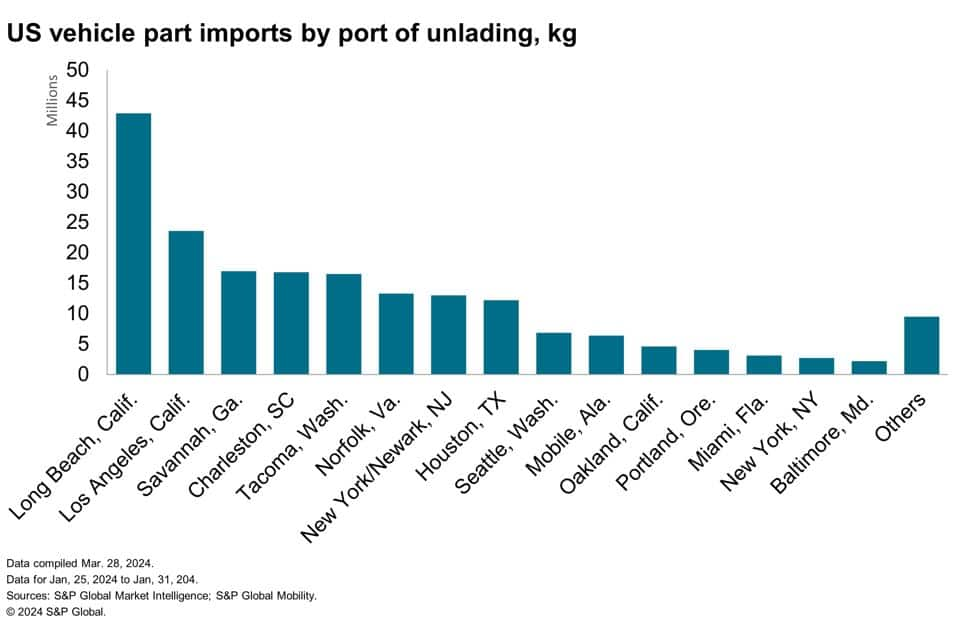

Further hope that supply chain disruption will be minimal is

provided by diving into Panjiva’s data on motor vehicle parts (HS

8708 for those interested). Examining the trade data for a one-week

period in January 2024 reveals that Baltimore is a much less

significant player when it comes to original equipment (OE) and

aftermarket parts. Here, Baltimore sits 15th in the list of US

ports and had just a 1.1% share of motor part traffic in the

week.

The primary concern for the industry will center on whether any

critical parts will be impacted by Baltimore’s immediate closure

with knock-on effects for vehicle production and vehicle option

availability. Here, there seems to be more good news for the

industry’s supply chain. Further examination of the motor vehicle

parts data relating to Baltimore does not throw up any significant

risks. A Cummins subsidiary, Cummins Cooling Products Inc., is

noted as the consignee for intercoolers and charge air coolers

shipped from mainland China. Elsewhere, a consignment of Dana drive

axles from Italy is noted.

All told, it seems fair to say that the Baltimore port incident,

while bringing short-term disruption to the industry, does not seem

set to roil the sector in the way that the COVID-19 pandemic,

semiconductors and the war in Ukraine have in recent history.

Subscribe to BriefCASE: Our

weekly AutoTechInsight newsletter featuring innovative automotive

insights and expert analysis

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

[ad_2]