January inventory trends: Advertised prices dropping, a full-size pickup glut, and EVs flattening out

[ad_1]

Retail advertised inventory data for January 2024: S&P

Global Mobility delivers the following US new vehicle market

insights:

Overall industry inventories

Available new vehicle dealer inventory listings for the US

market continued to surge as of the end of December. A steady

upward increase in advertised inventories has continued since

August, and now stands at 2.45 million vehicles.

Of course, sales are also on the rise. But plotting

year-over-year inventory growth, versus year-over-year sales

growth, shows that relative to volume, inventories are up 30%.

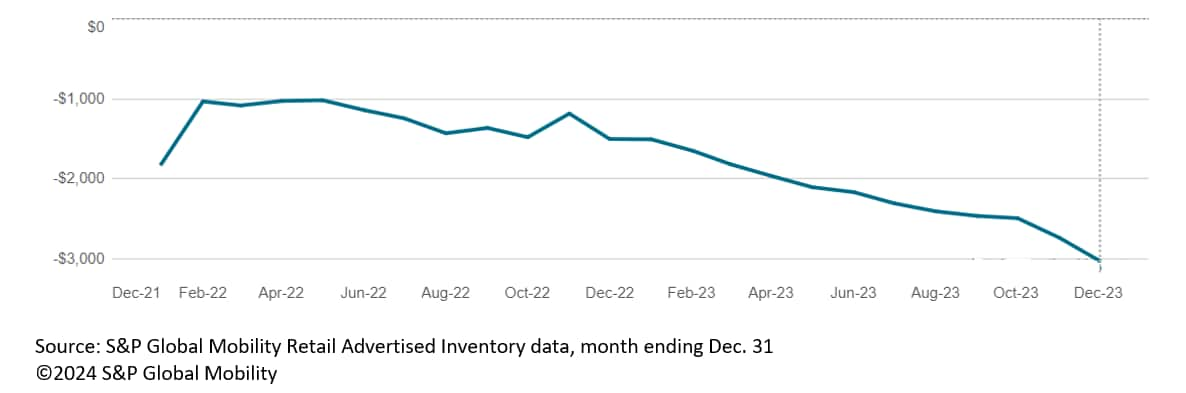

As inventories grow, listed prices and average MSRPs are

dropping – signaling automakers are building lower-trim models. But

also the number of vehicles with advertised prices listed below

MSRP are growing steadily. At the end of November, the average

advertised discount was $2,742; at the end of December, it had

grown to $3,030 (double the level of December 2022). And that is

the advertised price before negotiations or hidden

factory-to-dealer incentives – such as stair-step volume bonuses –

are factored in.

Average discount from MSRP

Which vehicle segments are hot, and are not?

Perhaps the most flooded major segment, relative to sales, is

that of full-size pickups (more on that below). Meanwhile, the

compact SUV segment has the most inventory – but it’s in line with

overall industry growth – and with registrations humming along at

about 200,000 per month, the C-SUV segment matches the ideal ratio

of two months’ supply.

As far as segments where one could argue there isn’t enough

inventory, the compact car, compact pickup, compact luxury SUV, and

full-size SUV segments are tight on units advertised in dealer

inventories.

Too many full-size pickups?

The full-size truck is a key profit generator for the Detroit 3.

But when too many are on showroom floors, deep discounting happens

in a rush. At the end of December, there were 307,000 full-size

pickups available, up from 229,000 the same time last year.

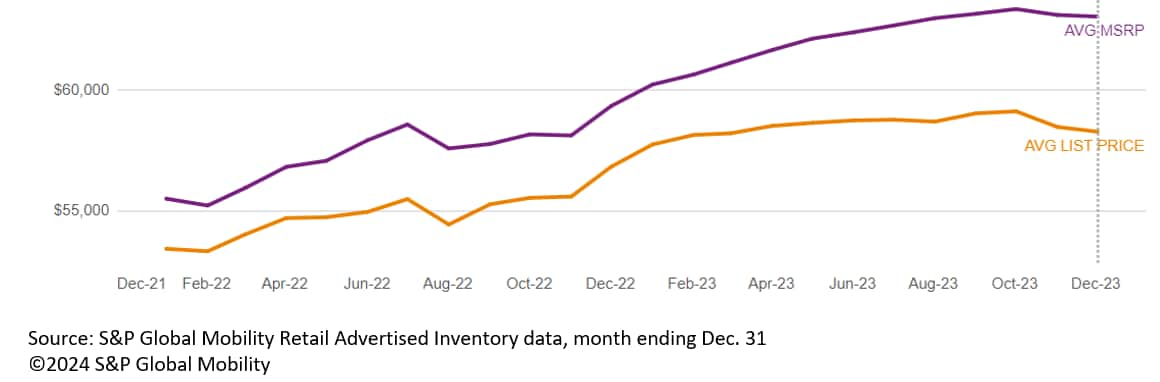

Meanwhile, the average MSRP has defied the industry trend,

increasing to $63,000, from $59,300 in December 2022 and $55,400 at

the start of 2022. But S&P Global Mobility analysis finds

advertised discounts steadily increased all through 2023, with

$4,740 the current average discount.

Average MSRP and list price, full-size pickup truck

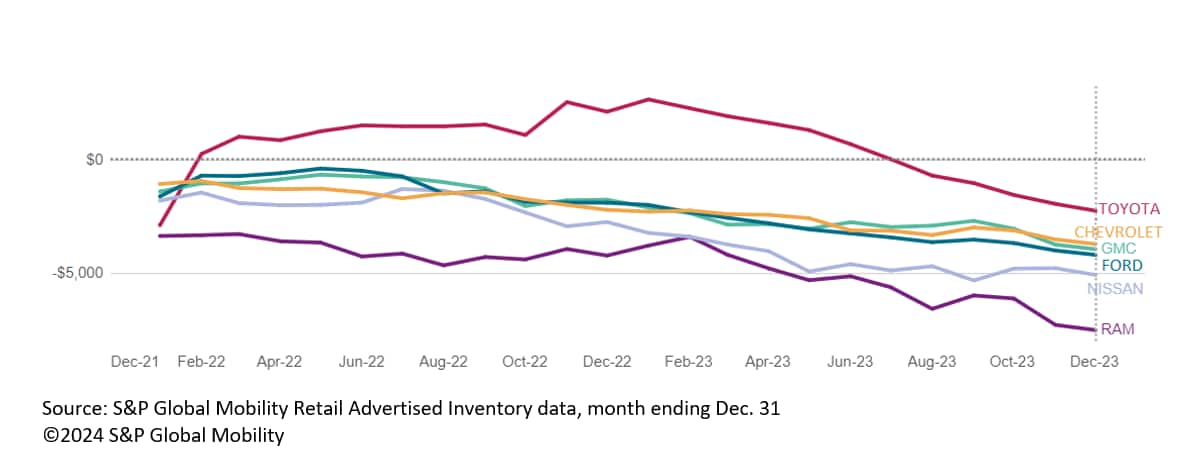

Who is slashing their big pickup prices? Ram dealers, with 75% of

dealer-advertised units below MSRP. The average discount is also

sizably more than that of the tight pack of Chevrolet, GMC, and

Ford. But even Toyota is discounting. Hot take? There is a lot of

inventory out there…deals could be coming.

Average discount from MSRP, full-size pickup truck

The mid-sized pickup battleground looming?

Toyota traditionally outsells its mid-size truck competitors

handily. <span/>But with

the redesigned 2024 Tacoma in factory ramp-up mode, and also in

high demand, inventories plummeted through the fourth quarter. At

the end of December, there were fewer Tacomas in dealer advertised

inventory than Jeep Gladiator or Nissan Frontier. While Toyota

dealers scramble to find units, might Jeep and Nissan dealers seize

on the opportunity to conquest consumers who <span/>can’t wait around for the new Tacoma?

Midsize pickup truck inventories

EV inventories stabilizing

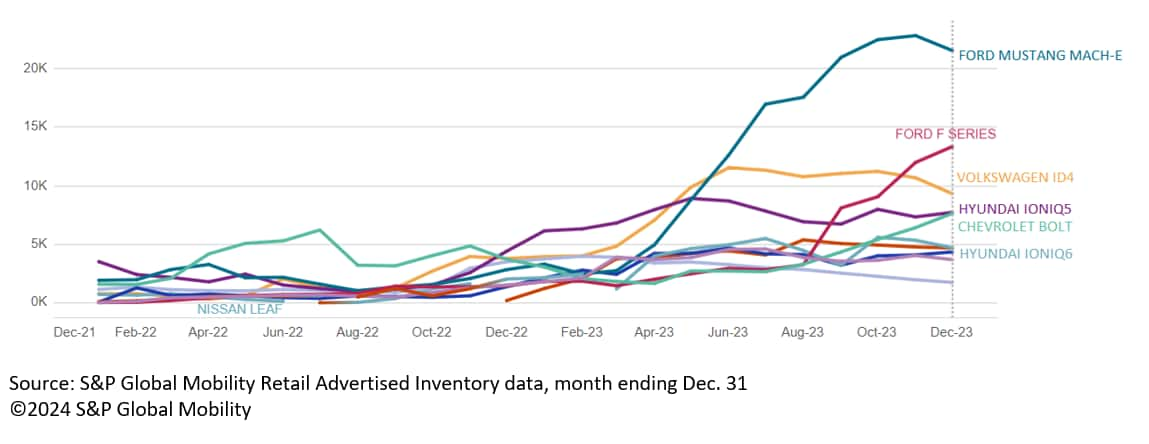

After growing through most of 2023, the end of December marked

the first drop in inventory all year for Ford’s Mustang Mach-E. But

with Ford selling fewer than 5,000 Mach-Es in a month, there still

is sizable backlog. A tougher tale to tell is F-150 Lightning,

which despite cutting production has seen inventory grow from 3,200

units in August to 13,000 at the end of December. At least Ford is

now selling lower-trim versions; the Lightning average MSRP is

roughly $74,000, whereas in December 2022 it carried an average

MSRP of $80,000 plus an $8,000 premium.

Other manufacturers are adjusting their EV inventories to

acknowledge market realities. Most EV inventories – VW ID4 and

Hyundai Ioniq, to name two leaders – have leveled off and are

burbling along between 3,000 and 5,000 units for the last quarter

or two, keeping pace with sales. The only real climber is the

Chevrolet Bolt EV/EUV, but Chevy dealers also are adding more

discounts on its compact EV. The key question still to be answered:

Are we seeing suppressed EV sales due to a lack of inventory, or a

lack of demand?

Electric vehicle inventories

FOR MORE ON INVENTORY DATA AND MARKET

INTELLIGENCE

LIGHT VEHICLE SALES FORECASTING

DOWNLOAD OUR TOP 10 INDUSTRY TRENDS

NEWSLETTER

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

[ad_2]