Lloyds to give Frazer notice of £1.2bn Telegraph loan repayment

[ad_1]

Ministers will be given notice on Wednesday that the Barclay family is ready to repay a £1.16bn loan to Lloyds Banking Group, paving the way for a public interest probe into the future ownership of The Daily Telegraph.

Sky News has learnt that Lloyds, the Barclays and RedBird IMI, the Abu Dhabi-backed vehicle which is funding the loan repayment, will write to Lucy Frazer, the culture secretary, to give her 48 hours notice of the redemption.

Sources said the notice – which had been demanded by Ms Frazer last week – would see the funds being transferred to Lloyds as early as Friday, or at the start of next week.

That would trigger the dissolution of a court hearing in the British Virgin Islands to liquidate a Barclay family company tied to the newspaper’s ownership, and temporarily put the Barclays back in control of their shares in the broadsheet title.

It would also necessitate the removal of AlixPartners as receiver to some of the companies in the Telegraph’s corporate structure.

However, the family is unlikely to be able to exert any influence over the Telegraph or Spectator magazine because – as Sky News revealed on Tuesday – the government is contemplating issuing a hold-separate notice which would ring-fence the media assets from their legal owners.

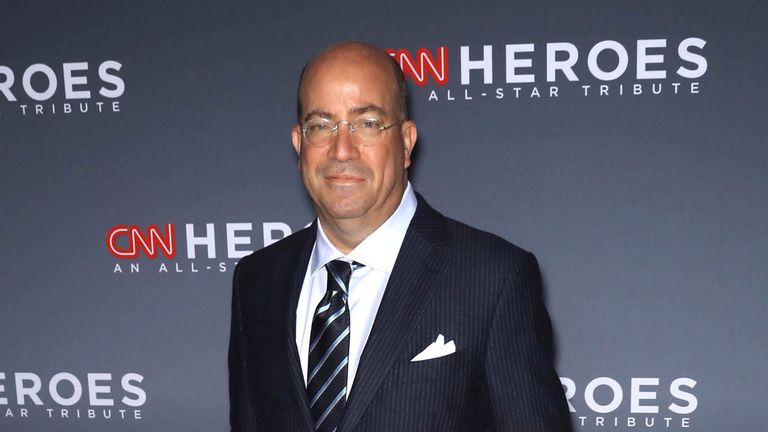

RedBird IMI, which is led by the former CNN president Jeff Zucker, intends to take control of the Daily and Sunday Telegraph by converting a £600m chunk of its loan to the Barclays into equity.

That conversion will, however, be the subject of a Public Interest Intervention Notice (PIIN) which is expected to be issued by the culture secretary before the end of the week.

The PIIN will trigger an inquiry by Ofcom and the Competition and Markets Authority which could last for months.

RedBird IMI’s offer to fund the loan redemption has circumvented an auction of the Telegraph titles which has drawn interest from a range of bidders.

It is unclear whether the auction process will continue once the funds are transferred to Lloyds.

The independent board brought in to oversee the sale of the Telegraph has already offered to remain in place during the government probe.

Lloyds wrote to government officials last Thursday to say it would support the retention of a trio of independent directors while a public interest inquiry is carried out.

The bank’s intervention has the backing of both the Barclay family and RedBird IMI, Sky News reported last week.

Ms Frazer has said she is minded to issue a PIIN amid concerns – including warnings from rival bidders – about possible editorial interference in the Telegraph’s journalism.

Last Friday Mr Zucker, who Sky News revealed last week was spearheading the deal, told the Financial Times that competing bidders were “slinging mud”.

“There’s a reason that people are slinging mud and throwing darts – [it’s] because they want to own these assets,” he told the newspaper.

“And they have their own media assets to try to hurt us.”

The battle for control of The Daily Telegraph has rapidly turned into a complex commercial and political row which has raised tensions between the Department for Culture, Media and Sport and the Foreign Office.

Prospective bidders led by the hedge fund billionaire and GB News shareholder Sir Paul Marshall have also been agitating for the launch of a PIIN.

RedBird IMI includes funding from Sheikh Mansour bin Zayed Al Nahyan, a member of Abu Dhabi’s royal family and owner of Manchester City.

Sky News revealed last week that Ed Richards, the former boss of media regulator Ofcom, is acting as a lobbyist for RedBird IMI through Flint Global, which was co-founded by Sir Simon Fraser, former Foreign Office permanent secretary.

The Telegraph auction, which has drawn interest from the Daily Mail proprietor Lord Rothermere and National World, a London-listed local newspaper publisher, has now been paused until next month.

The original bid deadline had been shifted from 28 November to 10 December to take account of the possibility that Lloyds could be repaid in full by the Barclay family ahead of the December 1 deadline.

Sky News reported earlier that the Barclays had now agreed not to contest the liquidation if they do not repay the loans by 1 December.

The Barclays have made a series of increased offers in recent months to head off an auction of the newspapers they bought nearly 20 years ago, raising its proposal last month to £1bn.

Until June, the newspapers were chaired by Aidan Barclay – the nephew of Sir Frederick Barclay, the octogenarian who along with his late twin Sir David engineered the takeover of the Telegraph in 2004.

Lloyds had been locked in talks with the Barclays for years about refinancing loans made to them by HBOS prior to that bank’s rescue during the 2008 banking crisis.

[ad_2]