New Car Prices Drop Year-Over-Year For First Time In A Decade

[ad_1]

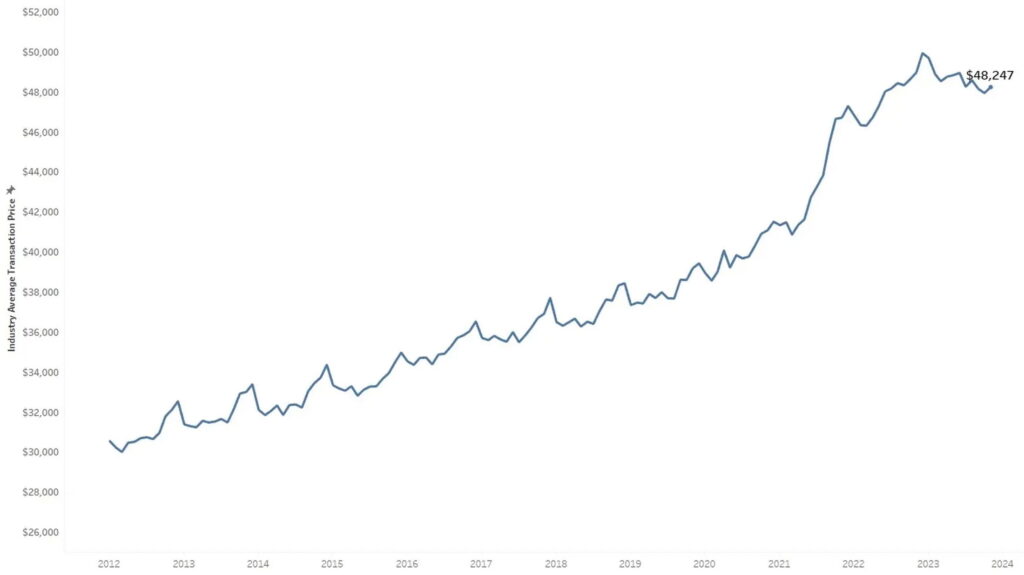

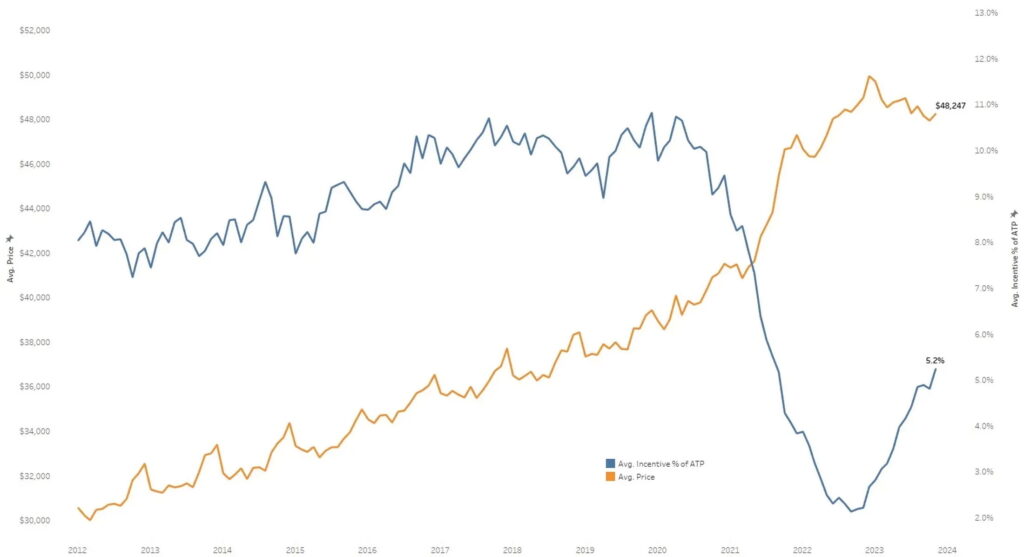

The months of September, October, and November 2023 were the only three months in the last decade when new vehicle prices shrank year-over-year, instead of growing. This contraction was due to dealers offering larger incentives than they have since the pandemic caused vehicle values to soar.

window.ramp.que.push(function () {

window.ramp.addTag(“pwMobiMedRectAtf”);

})

In November, the average transaction price (ATP) for a new vehicle was $48,247. While that was less than 1 percent higher than October’s ATP, it was 1.5 percent down as compared to November 2022.

That’s attributed to dealers offering buyers more incentives due to the normalization of supply, according to new data from Cox Automotive. While manufacturers’ suggested retail prices (MSRPs) increased by an average of around 1 percent from 2022 to 2023, sales incentives amounted to 5.2 percent of a vehicle’s ATP, the highest level since 2021.

advertisement scroll to continue

window.ramp.que.push(function () {

window.ramp.addTag(‘pwDeskMedRectAtf’);

})

window.ramp.que.push(function () {

window.ramp.addTag(“pwMobiMedRectBtf1”);

})

Read: BMWs Are The Fastest-Selling New And Used Cars In America

Put another way, the data shows that the size of incentives has more than doubled over the last year. And while that may be good news for buyers looking for a new vehicle, Rebecca Rydzewski, research manager at Cox Automotive, says that dealers aren’t as thrilled.

“While consumers may feel some relief in vehicle prices and incentives as we close out 2023, automakers and dealers are feeling the results of the downward price pressure,” said Rydzewski. “The latest dealer sentiment survey by Cox Automotive clearly indicates that dealers are seeing profits contract as inventory levels return to normal, and incentives are turned up to help stimulate sales.”

window._taboola = window._taboola || [];

_taboola.push({

mode: ‘thumbnails-a-mid’,

container: ‘taboola-mid-article’,

placement: ‘Mid Article’,

target_type: ‘mix’

});

The ATP for the average consumer was just 98.3 percent of MSRP in November 2023, the lowest level since April 2021. However, the situation remains better for buyers looking for a premium vehicle than those looking for an affordable one.

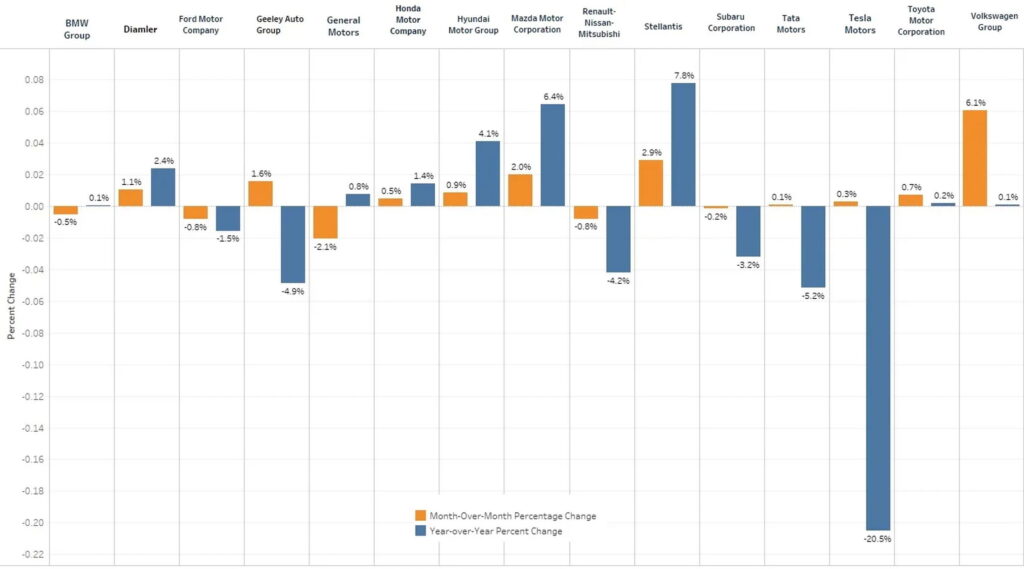

Luxury car prices drop 7.5%

The prices of new luxury vehicles fell by 7.5 percent last month, as compared to November 2022. Incentives in the market averaged 5.8 percent of the ATP, which helped sales increase by 19.6 percent year-over-year.

Incentives are also helping EV prices come closer to those of internal combustion vehicles. Buyers were offered deals worth 8.9 percent of their ATP in November, the highest levels seen in 2023. As a result, on average, EV only cost 8.5 percent more than the rest of the industry last month.

Mainstream car prices down 0.3%

Meanwhile, in November, the ATPs for non-luxury vehicles only decreased by 0.3 percent compared to the same month a year ago. Sales also saw growth, albeit less than the luxury market. This might be partially attributed to incentives being at just 5 percent, slightly lower than in the luxury market, and less than half as generous as those offered for non-luxury vehicles before the pandemic.

“In recent months, price parity between EVs and ICE has almost seemed possible,” said Stephanie Valdez-Streaty, director of Strategic Planning at Cox Automotive. “It is a complicated measure with plenty of variables, but newer products and higher discounts have brought down average EV prices, even before potential tax incentives. A year ago, the EV premium was more than 30%. Today, it’s less than 10%.”

[ad_2]