‘Very, very premature’ to be talking about interest rate cut, Bank of England governor warns

[ad_1]

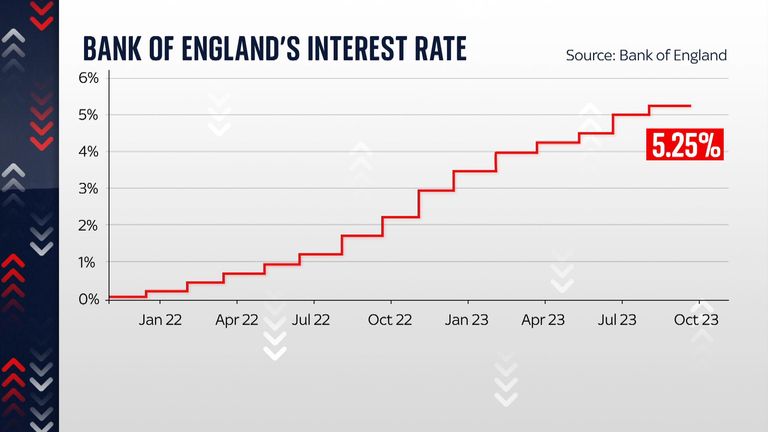

The Bank of England has warned against complacency after its interest rate was frozen at 5.25%.

Governor Andrew Bailey said he is determined to bring inflation back down to the target level of 2% – but with current rates at 6.7%, he added that “the job isn’t done yet”.

And amid speculation that the Bank’s base rate could now be close to peaking, he warned: “I can tell you we have not had any discussion on the Monetary Policy Committee about reducing rates because that would be very, very premature.”

Reaction to BoE’s decision – latest updates

The decision to leave the interest rate unchanged came a day after inflation unexpectedly fell by more than expected – ending the longest successive period of “tightening”.

Before now, the Bank had raised rates 14 times in a row – and the last time they were left unchanged was in November 2021.

The Monetary Policy Committee’s latest vote was a narrow one – and while five members had voted in favour of a freeze, four had felt rates should rise further.

On Wednesday, the US Federal Reserve had also opted to hold its interest rate steady – but crucially, both central banks are reserving the right to enforce further hikes in the future.

[ad_2]